2026 Grant PUD Employee Benefits Open Enrollment

Kickoff:

November 3, 2025

(Open enrollment start date)

final whistle:

november 17, 2025

(Open enrollment end date)

Changes will become effective and new programs will become available January 1, 2026!

EMPLOYEE PREMIUMS

PPO plan premiums increase by 12.3%; CDHP plan premiums stay the same. Dental plan and vision plan employee premiums stay the same.

COACH’S TIP: Compare medical plans and crunch the numbers to find out which medical plan saves you money. Download the health care cost calculator here.

TELEHEALTH PROVIDER CHANGE

Starting January 1, 2026, Doctor on Demand will be replaced by 98point6 (powered by Transcarent) for virtual general healthcare visits; Talkspace and Spring Health will provide virtual mental health therapy. You pay a $10 copay, regardless which medical plan you are enrolled in, when receiving services through these telehealth providers.

COACH’S TIP: Create an account now, before you need telehealth services!

premera health hub

Online wellness and condition management programs can provide you with tools and expert advice to help you achieve your health goals. Programs include weight management, diabetes management, mental well-being, women’s health, physical therapy, digestive health, smoking/tobacco use, and high blood pressure management. You will have access to the Health Hub starting January 1, 2026.

COACH’S TIP: If you are ready to improve your health, check out the lineup of virtual vendors standing by to help you achieve your health goals.

premera discount program

Free Blue365 discount program offers steep discounts related to fitness, apparel and footwear, hearing and vision, home and family, personal care, travel, etc. You have access to the discount program now.

COACH’S TIP: Save money by leveraging discounts offered through Premera’s Blue 365 discount program.

FLEXIBLE SPENDING (FSA)

Gallagher HealthInvest will be administering your FSA spending account. For 2026, you can set aside up to $3,400 for eligible health care expenses and up to $7,500 for dependent care expenses.

COACH’S TIP: FSA contributions reduce your taxable income and save you taxes. Plan carefully. You must use your medical FSA dollars by March 15, 2027; dependent care FSA dollars by December 31, 2026 or you lose them!

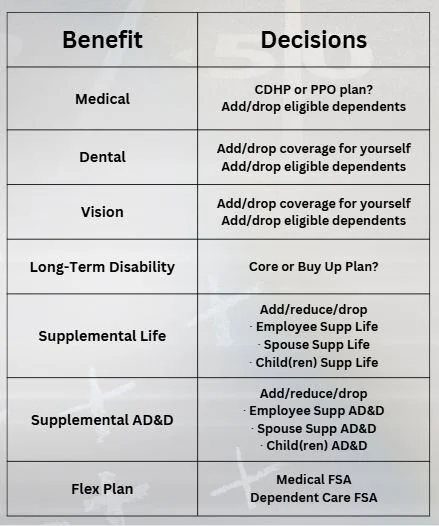

decision points for 2026

This is your opportunity to make changes to your benefit selections. You don’t have another chance to make changes until next year open enrollment, unless you have a qualifying life event.

COACH’S TIP:

Make sure your covered dependents are eligible for coverage. More here.

Download the long-term disability calculator to help you estimate your premiums and long-term disability benefits.

Supplemental life insurance coverage is guaranteed only during open enrollment ($200k for you, $25k for spouse, $10k for children). You can buy more than the guaranteed amount by providing evidence of insurability. Other restrictions apply. More here.

Evidence of insurability is never required for AD&D insurance, but some restrictions apply. More here.

Make sure your dependents are eligible under the Dependent Care FSA before you sign up. Learn more here and read IRS publication 503. NOTE: An eligible dependent care expense can be claimed on your income tax return or reimbursed from your Dependent Care FSA - but not both. Consult a tax professional to determine if contributing to a Dependent Care FSA is right for you!

Join us to discuss your options before the snap of the ball.

Submit your elections by November 17, 2025.

Once the enrollment window closes, your choices are locked in until 2027 (unless you have a qualifying life event).

Play #1 - DO NOTHING IF ….

You want to keep ALL benefits the same as last year AND don’t want to enroll in flexible spending (healthcare or dependent care reimbursement) for 2026. Not sure what you are enrolled in? Log into MyHR to view your current benefit enrollments.

Play #2 - LOG INTO MYHR IF ….

You want to change your benefits, buy additional life insurance, AND/OR enroll in flexible spending (healthcare or dependent care reimbursement) for 2025. You can make changes between November 3 – 17, 2025.

Please verify that your enrolled dependents continue to meet the eligibility guidelines. The plan reserves the right to audit dependent enrollment at any time to verify that enrolled dependents are eligible for coverage.

If you do not make changes now, your next chance to do so will be during our next open enrollment in 2026, unless you experience a qualifying life event, in which case you must notify Human Resources of the change within 30 days.

Your portion of the medical, dental, and vision premiums will be deducted from your paycheck on a pre-tax basis unless you tell us differently.

Make sure to read the 2026 annual notices.